Ever get that feeling, like you’re riding a wave that’s about to crash? Whether it’s a market trend, a personal goal, or just a really intense craving for pizza, knowing when things are likely to peak and then fade is a superpower. This article dives into the math behind those cycles, helping you understand the ebb and flow so you can stay ahead of the game. We’ll explore how to use ‘craving math’ to your advantage, making smarter decisions and building more resilience.

Key Takeaways

- Markets and economic trends often move in cycles, like a pendulum swinging. Understanding these patterns, instead of just focusing on what’s happening right now, helps you avoid being caught off guard. Studying market history is a good way to fight the tendency to only remember recent events.

- Our world is built for instant satisfaction, with everything available on demand. This makes it tough to delay gratification, whether it’s resisting a short-term fix in investments or managing personal desires. The allure of immediate pleasure can lead to long-term problems.

- Estimating ‘time-to-peak’ and ‘time-to-fade’ is a form of ‘craving math.’ It helps in managing effort and resources, like the ‘eight-hour burn principle’ which suggests that scarce resources are used more efficiently when time is limited.

- Building resilience involves skills like deferring gratification and learning to say ‘no.’ It also means reducing fragility by avoiding too much debt or reliance on single points of failure, and always having a ‘margin of safety.’

- Focusing on the inputs that build long-term value, rather than just short-term outputs, is key. This applies to personal goals, business strategies, and nurturing relationships, ensuring sustained success and enduring connections.

Understanding The Craving Cycle

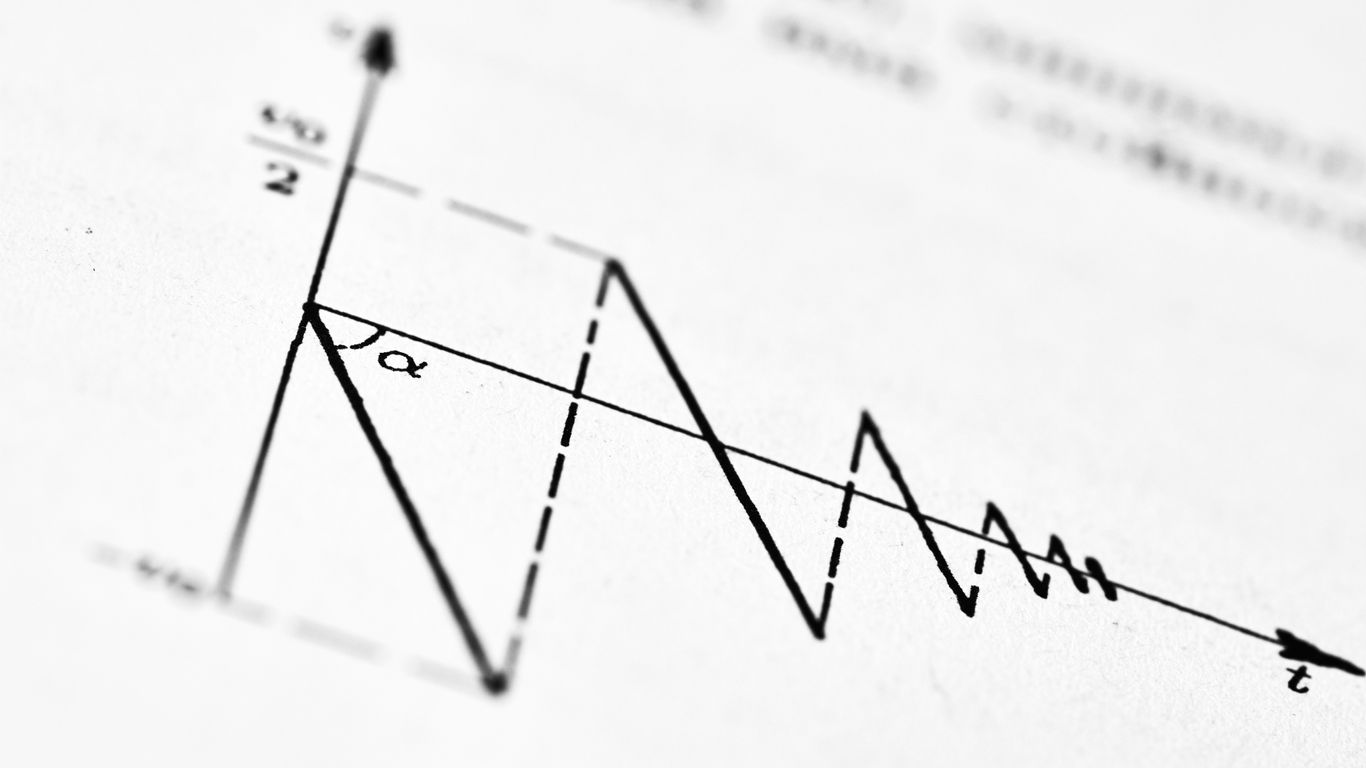

Markets, like life, don’t just move in a straight line. They tend to swing back and forth, kind of like a pendulum. Think about it: economies grow, then they shrink. People spend money, then they hold onto it. Companies make profits, then they don’t. Credit gets easy to get, then it gets tough. Prices for everything go up, then they come down. This back-and-forth is a cycle, and it happens over and over.

Recognizing Cyclical Patterns In Markets

It’s easy to get caught up in what’s happening right now. If stocks are going up, we think they’ll keep going up forever. If they’re falling, we panic and think they’ll never recover. This is called recency bias – we put too much weight on what just happened. But history shows us that these trends don’t last. Understanding these patterns helps us avoid being surprised and can even help us make better decisions. The key is to remember that extremes rarely last.

The Pendulum Swing Of Economic Trends

Imagine a pendulum. It swings from one side to the other, and then back again. Economic trends work the same way. When things are good, they tend to get really good, maybe even too good. Then, they swing back the other way, sometimes quite hard. This swing is predictable, even if the exact timing isn’t. We can’t know the future for sure, but we can see the patterns of the past repeating.

Combating Recency Bias With Market History

Our brains are wired to forget bad experiences. It’s a survival thing, I guess. But in the world of investing, forgetting the painful lessons of the past is a big mistake. Studying market history is like looking at a map of where others have stumbled. It doesn’t tell you exactly what will happen next, but it shows you the common pitfalls. By learning from history, we can fight that urge to only focus on the recent past and make more sensible choices.

We tend to be drawn to what feels good right now, even if it causes problems later. This happens in our personal lives and in the markets. It’s a natural human tendency, but it’s one we need to be aware of if we want to succeed long-term.

The Allure Of Instant Gratification

It feels like everything these days is designed to give us what we want, right now. From streaming services that play the next episode automatically to apps that deliver food in minutes, we’re living in an ‘on-demand’ world. This constant availability can really mess with our heads, especially when it comes to making smart choices. We’re wired to seek out pleasure and avoid discomfort, and that’s exactly what instant gratification taps into. It’s easy to get caught up in the immediate reward, forgetting about the longer-term effects. This isn’t just about personal habits; it shows up in bigger things too, like how we manage money or even how we treat the planet.

Our On-Demand World And Shortened Attention Spans

Think about how much information comes at you every day. Emails, social media notifications, news alerts – it’s a constant barrage. Our brains are adapting to this fast pace, and honestly, our attention spans are shrinking. We want things quickly, and we get frustrated when we have to wait. This is a big deal because it affects how we learn, how we make decisions, and how we interact with the world. Technology, while amazing, is often built to grab and hold our attention, sometimes at the expense of our focus on what truly matters.

The Perils Of Short-Term Fixes

Chasing that quick win or immediate relief can lead us down a slippery slope. It’s like taking a painkiller for a broken bone – it might ease the immediate ache, but it doesn’t fix the underlying problem. In markets, this often means making impulsive trades based on short-term news, rather than sticking to a well-thought-out strategy. We might see a quick profit, but we could also miss out on bigger, more sustainable gains or even suffer significant losses. The temptation for a quick fix often distracts us from the patient work required for lasting success.

Pleasure Seeking Versus Long-Term Consequences

Our brains are naturally drawn to things that feel good in the moment. This ‘pleasure-seeking’ drive is powerful, but it can also lead us to ignore potential negative outcomes down the road. Consider the difference between saving money for a future goal versus spending it all on immediate wants. The immediate joy of spending is real, but the long-term consequence is a lack of financial security. This same dynamic plays out in many areas of life, from personal health to career choices, and especially in how we approach investments. We have to consciously work against this natural tendency to prioritize the present over the future.

Quantifying Craving Math

It’s easy to get caught up in the moment, chasing that immediate hit of satisfaction. But when it comes to anything that truly matters, whether it’s building a business, mastering a skill, or even just sticking to a healthy habit, we need to think about the whole arc of the experience. This means understanding not just when things feel good, but also when they’re likely to peak and, importantly, when they’ll start to fade. This isn’t about predicting the future with perfect accuracy, but about developing a feel for the natural rhythms of effort and reward.

Estimating Time-to-Peak Performance

Think about any endeavor you’ve undertaken. There’s usually a point where things really start clicking. You’ve put in the groundwork, learned the ropes, and suddenly, you’re performing at your best. Estimating this ‘time-to-peak’ is about recognizing the learning curve and the compounding effect of your efforts. It’s not a fixed number; it depends on the complexity of the task and your dedication. For instance, learning a new software might take a few weeks to reach a comfortable proficiency, while mastering a musical instrument could take years to hit a true peak.

- Initial learning phase: High effort, low output.

- Skill acquisition: Output increases as understanding grows.

- Peak performance: Mastery and efficiency are achieved.

Calculating Time-to-Fade For Sustained Effort

Just as things peak, they also tend to fade. This isn’t necessarily a negative thing. It’s the natural ebb and flow. For sustained effort, understanding the ‘time-to-fade’ helps you manage your energy and expectations. It’s about knowing when you might need to rest, pivot, or simply accept that the intense phase is over and a new, perhaps less demanding, phase is beginning. For example, a marketing campaign might have a strong initial surge, but its effectiveness will likely decrease over time without fresh input.

Recognizing the point at which an effort begins to lose its initial impact is key to avoiding burnout and making informed decisions about resource allocation. It’s about working with the natural cycle, not against it.

The Eight-Hour Burn Principle

This concept, often seen in productivity circles, suggests that for many tasks, working intensely for about eight hours is often the most productive stretch. Beyond that, diminishing returns set in, and the quality of your output can suffer. It’s a rough guideline, not a strict rule, but it highlights the idea that sustained, unbroken effort isn’t always the most effective. It acknowledges that our energy and focus naturally fluctuate. Applying this principle means being mindful of when you’re most effective and when pushing harder might actually be counterproductive. It’s about quality of effort, not just quantity.

- Focused Work Blocks: Aim for periods of deep concentration.

- Scheduled Breaks: Step away to recharge and prevent fatigue.

- Review and Adjust: Assess your energy levels and adjust your schedule accordingly.

Strategic Approaches To Outlasting Cravings

It’s tough, right? We live in a world that’s basically built for instant satisfaction. Everything’s on demand, from your morning coffee to that show you want to binge. Our brains are wired to chase that quick hit of pleasure, and that’s exactly what cravings tap into. But if we want to achieve anything meaningful, especially in the long run, we’ve got to get better at handling these urges. It’s not about denying yourself forever, but about learning to wait for the right moment, or sometimes, just saying ‘no’ altogether.

Deferring Gratification As A Skill

Think of deferring gratification like building a muscle. The more you practice it, the stronger it gets. In our hyper-connected world, this is harder than ever. Notifications ping, markets move in seconds, and the temptation to act now is constant. But true success, whether in investing or personal goals, often comes from resisting that immediate impulse. It means looking past the quick win and focusing on the bigger picture. The ability to delay pleasure is a key differentiator between those who achieve lasting success and those who don’t.

The Importance Of Saying No

Learning to say ‘no’ is a superpower in disguise. In investing, this means resisting the urge to jump into every hot stock or chase every market trend. It’s about sticking to your plan and waiting for opportunities that truly align with your goals, even if it means sitting on cash for a while. This discipline helps you avoid costly mistakes and keeps you from overpaying for assets. It’s not about being negative; it’s about being selective and protecting your capital.

Building Resilience Against Market Volatility

Markets are going to do what markets do – they go up, they go down, and sometimes they do both very quickly. Trying to predict these moves is a losing game. Instead, focus on building resilience. This means understanding that ups and downs are normal, not a sign that the system is broken. It’s about identifying what makes you vulnerable – maybe it’s taking on too much debt, or investing in things you don’t understand – and actively working to reduce those weak spots. Being prepared for the unexpected is far more effective than trying to guess when it will happen.

Uncertainty isn’t a bug; it’s a feature of most systems, especially financial markets. Expecting it and building defenses against it is the smart play.

Focusing On Inputs For Long-Term Value

It’s easy to get caught up in the daily ups and downs, right? Like checking your phone every five minutes to see how your favorite stock is doing. But if you’re really trying to build something that lasts, whether it’s a business, your personal finances, or even just your own well-being, you’ve got to shift your focus. We need to look beyond the immediate results and think about what’s actually driving those results.

Destination Analysis For Personal Goals

Think about where you want to end up. Seriously, picture it. If your goal is to be healthy when you’re older, what are you doing today? Are you eating decent food, moving your body, getting enough sleep? It’s not about hitting the gym for two hours tomorrow; it’s about the consistent habits that add up. Same goes for relationships. If you want people to remember you fondly, how are you treating them now? Are you showing up, being kind, listening? It’s the daily actions, the inputs, that shape your future destination.

Evaluating Business Inputs Beyond Short-Term Outputs

Businesses often get stuck looking at the next quarter’s profits. But what about the stuff that makes those profits possible down the road? Are they treating their customers well? Are they treating their employees fairly? Are they making smart choices about where to put their money for the long haul, not just for a quick win? Ignoring these inputs is like trying to grow a garden by only looking at the flowers that bloomed this week, without watering the soil or checking for pests. You might have a nice bloom now, but the plant won’t last.

Here’s a simple way to think about it:

- Customer Satisfaction: Are customers getting good products and service?

- Employee Morale: Are your team members motivated and treated well?

- Supplier Relationships: Are you building partnerships or just squeezing every last penny?

- Capital Allocation: Is money being invested wisely for future growth?

Nurturing Relationships For Enduring Success

This applies everywhere, not just in business. Think about your friendships or family ties. Are you putting in the effort? Are you making time for people, being supportive, and communicating honestly? It’s the consistent, small efforts – the inputs – that build strong, lasting relationships. Trying to

The Role Of Uncertainty In Decision Making

Look, nobody has a crystal ball. Markets, economies, even our own lives – they’re all messy and unpredictable. Trying to plan for every single possibility is a losing game. Instead, we need to get comfortable with the fact that things are going to be uncertain. It’s not a bug in the system; it’s just how things work.

Respecting Uncertainty As A System Feature

Think about it. We’ve seen all sorts of crazy stuff happen over the years, right? Wars, recessions, pandemics. These aren’t rare glitches; they’re part of the deal. We can’t predict exactly when or how these disruptions will hit, but we can expect them. The smart move is to prepare so that when they do happen, they don’t knock us completely off our feet. It’s way easier to spot something that’s fragile than to guess when a bad event might strike.

The future is a big question mark. Trying to nail down exactly what’s going to happen is a fool’s errand. Acknowledging that we don’t know everything is actually a strength, not a weakness. It helps us stay grounded.

Identifying And Reducing Fragility

So, how do we get ready for the unexpected? We need to look at where we’re weak. Are you putting all your eggs in one basket? Maybe all your money is in one type of investment, or one bank, or even one country. That’s a recipe for disaster if things go south. We need to spread things out and cut down on anything that makes us overly dependent on one thing working out.

Here are a few things to consider:

- Debt and Leverage: Too much debt makes you vulnerable. If you can’t make payments, you’re in trouble fast.

- Concentration Risk: Having everything tied to one asset, one company, or one sector is risky. Diversify!

- Over-reliance: Depending too much on a single income source or a single client can be dangerous.

The Power Of A Margin Of Safety

Knowing that things can go wrong, we need a buffer. This is where a margin of safety comes in. It means not pushing things to the absolute limit. It’s like building a bridge that’s stronger than it needs to be for the heaviest truck it’s expected to carry. This buffer protects you when things don’t go as planned. It’s not about being scared; it’s about being smart and prepared. This allows you to stay in the game, even when others are panicking. Sometimes, when things look bad for everyone else, that’s when the real opportunities show up for those who are ready.

| Area of Focus | Potential Fragility | How to Reduce | Example |

|---|---|---|---|

| Investments | All in one stock | Diversify across sectors and geographies | Invest in an ETF that tracks a global index |

| Finances | High personal debt | Pay down debt, build emergency fund | Reduce credit card balances, save 6 months of expenses |

| Business | Single major client | Develop multiple revenue streams | Acquire smaller clients, explore new markets |

Avoiding The Pitfalls Of Measurement

It’s easy to get caught up in numbers. We see charts, graphs, and percentages everywhere, and it feels like the only way to know if we’re doing well is by looking at these figures. But sometimes, focusing too much on what we can measure can actually lead us astray. It’s like trying to find your way by only looking at the speedometer on your car – it tells you how fast you’re going, but not if you’re heading in the right direction or if you’re about to run out of gas.

The Dangers Of External Metrics

We often fall into the trap of using outside benchmarks to judge our own progress. Think about social media likes, or how many people are watching your videos, or even how much money is in your bank account. These are all external things. While they can be indicators, they aren’t the whole story. When we tie our sense of worth or success too tightly to these external numbers, we risk losing sight of what truly matters to us. It can turn into a constant game of comparison, where we’re always looking at what others have or what the latest number says, instead of focusing on our own journey and our own goals. It’s like trying to measure the warmth of a hug by counting the number of seconds it lasts – you miss the actual feeling.

When Peak Performance Isn’t The Goal

Sometimes, the aim isn’t to be the absolute best or to hit some record-breaking number. Maybe you’re just trying to get better at something, or maintain a certain level of skill, or simply enjoy the process. In these cases, chasing a

Leveraging Technology Thoughtfully

It’s easy to get caught up in the latest tech gadgets and software, thinking they’ll magically solve all our problems. But technology, at its core, is a tool. The real magic happens when we use it to amplify what humans do best, not replace it. We need to be mindful of how we build and use these tools, considering the impact on people’s time and attention.

Algorithms As Tools For Augmentation

Algorithms are powerful, but they’re essentially thoughtless. They follow instructions. When we design them, we’re embedding our own thinking – or lack thereof – into the system. Instead of just automating tasks, we should aim for algorithms that help us do things we couldn’t do before, augmenting our own intelligence and capabilities. Think of it like giving yourself a superpower, not just a faster way to do chores.

Considering The User’s Clock

When you’re building something that uses people’s time, you’re asking them to spend their heartbeats on your creation. It’s a big ask. We need to ask ourselves if we’re respecting that time. Are we helping people organize their lives, or are we just adding to the noise and distraction? It’s about building with empathy, understanding that every moment a user spends with your product is a choice they’re making.

Responsible Technology Design

Our technological capabilities are advancing faster than our culture can always keep up. This means we have a significant responsibility to think about the broader impact of what we create. It’s not just about the next shiny feature; it’s about the kind of world we’re shaping for the future. We need to be intentional, asking if our designs are humane and if they genuinely serve people’s long-term well-being, rather than just short-term engagement.

Technology should aim to amplify human capabilities, not replace them. The goal is to enable people to think in new ways and solve complex problems, making our lives better and more meaningful.

The Value Of Patience In Investment

When you’re looking at the stock market, it’s easy to get caught up in the day-to-day ups and downs. Everyone wants to see their investments grow, and grow fast. But the truth is, real wealth building often takes time. It’s about playing the long game, not just chasing quick wins.

Waiting For Good Businesses At Good Prices

Think about it like this: you wouldn’t buy a house without checking it out thoroughly, right? You’d look at the foundation, the roof, the neighborhood. Investing in a business should be similar. We’re looking for solid companies, ones with a good track record and a clear path forward. But these opportunities don’t pop up every day. Sometimes, you have to wait for the right moment, when a great company is available at a price that makes sense. This means not rushing in just because everyone else is buying. It’s about finding those gems when they’re overlooked.

Disciplined Cash Management

Having cash on the sidelines isn’t a sign of failure; it’s a sign of smart planning. When you have cash ready, you’re in a much better position to act when those rare opportunities arise. It also means you’re not forced to sell something you own just because you need money. This discipline helps you avoid making emotional decisions, especially when the market gets a bit shaky. It’s like having a safety net that lets you wait for the best deals without feeling pressured.

Surviving Market Dips With Fortitude

Markets go up, and markets go down. That’s just how it works. Anyone who tells you otherwise isn’t being realistic. The real test of an investor isn’t just when things are going well, but how they handle the tough times. When the market dips, it can feel scary. Your instinct might be to panic and sell everything. But often, these dips are temporary. If you’ve invested in solid businesses, they’ll likely recover. Staying calm and sticking to your plan, even when it’s hard, is what separates those who build wealth over time from those who don’t.

The market can be irrational in the short term, but over the long haul, it tends to get things right. Patience allows you to benefit from this eventual rationality.

Cultivating Shock Resistance

Life, and especially markets, throws curveballs. It’s not a matter of if something unexpected will happen, but when. Building shock resistance means preparing for those inevitable disruptions so they don’t knock you out of the game. It’s about being able to take a hit and keep going, maybe even come out stronger.

Avoiding Ruin and Staying in the Game

Think of it like this: you can have the best strategy in the world, but if one bad event wipes you out completely, it doesn’t matter. The primary goal isn’t just to win, but to survive long enough to see opportunities. This means being really careful about how much risk you take on. Too much debt, for instance, makes you fragile. If your income suddenly stops, you’re in trouble fast. Similarly, putting all your eggs in one basket – whether it’s one type of investment, one company, or even one currency – is asking for trouble down the road. It might seem fine for a while, but eventually, something will go wrong.

- Identify your weak spots: Where are you most vulnerable to a sudden shock?

- Reduce those vulnerabilities: Can you spread things out? Can you build a buffer?

- Prioritize survival: Sometimes, the best move is to do nothing and just wait it out.

The market doesn’t care about your plans. It operates on its own terms, and those terms often involve unexpected twists. Being prepared for the worst isn’t about being negative; it’s about being realistic and giving yourself the best chance to stick around when things get tough.

The Upside of Economic Growth

While we focus on avoiding disaster, it’s also true that economies tend to grow over time. People have more kids, we get better at making things, and technology advances. These are powerful forces that, over the long haul, tend to push things upward. Compounding, that magical effect where your gains start earning their own gains, also plays a big role. So, while we need to be vigilant about the downside, we can also trust that, generally speaking, things tend to get better. This growth is often the tailwind that helps us recover from setbacks and eventually reach new heights.

Confronting Downside Risks

Ignoring the possibility of things going wrong is a recipe for disaster. We have to actively think about what could go wrong and how bad it could be. This isn’t about being scared; it’s about being smart. It means not getting too cocky when things are going well, because that’s often when we’re most likely to make mistakes. We need to be aware that our own thinking can trick us into believing the future will be just like the recent past, which is rarely the case. So, we need to build in a safety net, a margin of safety, that protects us even if our predictions are off. This means being disciplined, saying no to bad deals, and managing our cash wisely, even when it feels boring. It’s about playing the long game, not just chasing the next quick win.

Building resilience is key to handling life’s curveballs. Just like a muscle, your ability to bounce back gets stronger with practice. Want to learn how to develop this inner strength and face challenges head-on? Visit our website for practical tips and guidance on cultivating shock resistance. Discover how to build a stronger you today!

So, What’s the Takeaway?

Look, figuring out how long something’s going to last, whether it’s a good mood, a project deadline, or even just a craving, isn’t an exact science. It’s more like reading the weather. We’ve talked about how things tend to swing back and forth, like a pendulum, and how our brains sometimes forget the tough times. The big idea here is to not get caught off guard. By thinking about these cycles and being aware of our own tendencies, we can get better at handling the ups and downs. It’s about being prepared, not just for the peak, but for the fade too. This way, we can make smarter choices and maybe even enjoy the ride a little more, knowing that nothing lasts forever, good or bad.

Frequently Asked Questions

What is the ‘craving cycle’ in markets?

Think of the market like a seesaw. It goes up for a while, then it comes down. The craving cycle is about understanding these ups and downs, like how long the seesaw stays up before it starts to go down, and how long it stays down before it goes up again. Knowing this helps you not get surprised when it changes direction.

Why is ‘instant gratification’ a problem?

We live in a world where we can get almost anything right away – food, entertainment, you name it. This makes it hard to wait for things. In markets, wanting quick profits can lead to bad choices that hurt you later on.

How can I ‘outlast’ a craving or a market trend?

It’s about building patience and self-control. Instead of jumping in right away for a quick win, you learn to wait for better opportunities. This means saying ‘no’ to tempting but risky choices and sticking to a plan, even when things get tough.

What does ‘deferring gratification’ mean?

It means choosing a bigger, better reward in the future instead of a small, quick reward now. Like saving your allowance to buy a bigger toy later instead of spending it all on candy today. It’s a skill that helps you avoid making impulsive decisions.

How does understanding market history help?

Markets have patterns that repeat over time. By studying what happened in the past, you can get a better idea of what might happen in the future. It helps you avoid making the same mistakes others have made because they forgot the lessons of history.

What’s the ‘Eight-Hour Burn Principle’?

This idea suggests that when you have too much time to do something, you don’t value your time as much. By limiting your work time, like to eight hours, you make that time more precious and use it more wisely and efficiently.

Why is it important to focus on ‘inputs’ for long-term success?

Instead of just looking at the results you get right now (like profits), it’s better to focus on the actions and efforts you put in. For example, are you treating customers well? Are you making smart decisions for the future? These ‘inputs’ build lasting value.

How can I become more ‘shock resistant’ in investing?

This means being prepared for unexpected problems, like market crashes. You can do this by not putting all your money in one place, avoiding too much debt, and focusing on not losing everything. This way, you can stay in the game even when things get rough.